Chipotle’s Business Model and Performance

Chipotle Mexican Grill has established itself as a leading player in the fast-casual dining industry, renowned for its commitment to fresh ingredients and customizable menu. Its unique business model, coupled with its dedication to quality and customer satisfaction, has propelled the company to significant success.

Chipotle’s business model revolves around providing customers with a fast, fresh, and customizable dining experience. The company sources its ingredients from farms and suppliers that meet its strict quality standards, ensuring that its menu items are made with fresh, wholesome ingredients. This emphasis on quality has resonated with health-conscious consumers seeking a convenient and flavorful alternative to traditional fast food.

Chipotle’s Recent Financial Performance

Chipotle’s financial performance has been consistently strong in recent years, reflecting the company’s successful business strategy. The company’s revenue has grown steadily, driven by increased customer demand and expansion into new markets. Chipotle’s profitability has also improved, as the company has focused on optimizing its operations and controlling costs.

- Revenue Growth: Chipotle’s revenue has consistently grown over the past several years, demonstrating the company’s strong market position and customer demand. In 2022, the company reported total revenue of $8.5 billion, a significant increase from the previous year. This growth can be attributed to factors such as new restaurant openings, menu innovation, and increased digital ordering.

- Profitability: Chipotle’s profitability has also been on an upward trend. The company’s operating margin has improved in recent years, reflecting its focus on cost management and operational efficiency. In 2022, Chipotle’s operating margin was 16.2%, indicating strong profitability and a healthy financial position.

- Same-Store Sales: Same-store sales, a key metric for measuring a company’s performance in existing locations, have also been positive for Chipotle. The company’s same-store sales have consistently grown in recent years, demonstrating its ability to attract and retain customers. In 2022, Chipotle reported same-store sales growth of 10.8%, indicating strong customer loyalty and continued demand for its products.

Chipotle’s Customer Attraction and Retention Strategies, Chipotle stock

Chipotle employs various strategies to attract and retain customers, including its loyalty program and digital ordering platform. These initiatives aim to enhance the customer experience and foster loyalty, contributing to the company’s sustained success.

- Loyalty Program: Chipotle’s loyalty program, known as Chipotle Rewards, offers customers exclusive benefits and rewards for their patronage. Members earn points for every purchase, which can be redeemed for free food and other perks. The program incentivizes repeat business and encourages customers to engage with the brand.

- Digital Ordering Platform: Chipotle’s digital ordering platform provides customers with a convenient and efficient way to place orders. Customers can order online or through the mobile app, allowing them to skip the line and customize their meals. The platform also enables personalized recommendations and offers, further enhancing the customer experience.

Industry Trends and Competitive Landscape: Chipotle Stock

The fast-casual restaurant industry is a dynamic and competitive landscape, constantly evolving in response to changing consumer preferences, technological advancements, and economic factors. This section will delve into the key trends shaping the industry, examine Chipotle’s competitive positioning, and explore the challenges and opportunities it faces in the coming years.

Current Trends in the Fast-Casual Restaurant Industry

The fast-casual restaurant industry is characterized by several prominent trends:

- Growing Demand for Fresh, High-Quality Ingredients: Consumers are increasingly seeking out restaurants that offer fresh, high-quality ingredients, often sourced locally or sustainably. This trend has driven the rise of fast-casual chains like Chipotle, which focus on using real, whole ingredients in their menu items.

- Emphasis on Customization and Personalization: Consumers desire personalized dining experiences, with the ability to customize their orders to their specific preferences. Fast-casual restaurants have responded by offering a wide range of customization options, allowing customers to build their own meals or choose from a variety of pre-configured options.

- Technological Advancements: Technology is playing a growing role in the fast-casual restaurant industry, with digital ordering, mobile payments, and delivery services becoming increasingly common. These advancements have improved convenience and efficiency for both customers and restaurants.

- Focus on Health and Wellness: Consumers are increasingly conscious of their health and wellness, and are looking for restaurants that offer healthier menu options. Fast-casual chains are responding by offering more vegetarian, vegan, and gluten-free options, as well as incorporating healthier ingredients and cooking methods.

Chipotle’s Competitive Positioning

Chipotle occupies a strong position within the fast-casual restaurant industry, known for its commitment to fresh ingredients, customizable menu, and focus on sustainability.

- Unique Value Proposition: Chipotle’s value proposition centers around providing fresh, high-quality food made with real ingredients, offering a customizable experience, and prioritizing sustainability. This unique combination has resonated with consumers seeking healthier and more ethical dining options.

- Brand Loyalty: Chipotle has built a strong brand identity and loyal customer base. Its focus on transparency and quality has earned the trust of its customers, leading to high levels of repeat business and positive word-of-mouth marketing.

- Strong Financial Performance: Chipotle has consistently delivered strong financial performance, demonstrating its ability to navigate industry challenges and capitalize on growth opportunities. This financial stability has enabled the company to invest in expansion, innovation, and technology.

Competitive Landscape

Chipotle faces competition from a wide range of players in the fast-casual restaurant industry, including:

- Panera Bread: Known for its bakery-cafe concept, Panera Bread offers a wide range of menu items, including sandwiches, salads, soups, and baked goods. It emphasizes fresh ingredients and a comfortable dining environment.

- Subway: Subway is a global fast-food chain specializing in customizable sandwiches and salads. Its focus on affordability and customization has made it a popular choice for consumers.

- Shake Shack: Shake Shack is a popular burger chain known for its premium burgers, fries, and shakes. It emphasizes fresh, high-quality ingredients and a casual dining experience.

Challenges and Opportunities

Chipotle faces several challenges and opportunities in the coming years:

- Rising Food Costs: Rising food costs can impact Chipotle’s profitability and ability to maintain its pricing strategy. The company must find ways to manage costs effectively while maintaining the quality of its ingredients.

- Labor Shortages: The restaurant industry is facing labor shortages, which can lead to increased labor costs and operational challenges. Chipotle must attract and retain employees by offering competitive wages and benefits, as well as creating a positive work environment.

- Changing Consumer Behavior: Consumer preferences and eating habits are constantly evolving, and Chipotle must adapt to these changes to remain competitive. This includes offering new menu items, expanding delivery options, and incorporating new technologies to enhance the customer experience.

- Increased Competition: The fast-casual restaurant industry is highly competitive, with new players emerging and existing chains expanding their offerings. Chipotle must differentiate itself by continuing to innovate, maintain its commitment to quality, and enhance its customer experience.

Key Factors Influencing Chipotle Stock

Chipotle Mexican Grill’s stock performance is influenced by a multitude of factors, ranging from the broader economic environment to the company’s own strategic decisions. Understanding these key drivers is crucial for investors seeking to gauge the potential future direction of Chipotle’s stock price.

Economic Conditions

The macroeconomic environment plays a significant role in shaping consumer behavior and, consequently, Chipotle’s financial performance. Factors such as inflation, interest rates, and consumer spending directly impact the company’s revenue and profitability.

During periods of high inflation, Chipotle may face pressure to raise prices to maintain profitability. However, this could potentially lead to a decrease in demand, especially among price-sensitive consumers. Conversely, lower interest rates can encourage borrowing and spending, potentially boosting demand for Chipotle’s products.

Similarly, changes in consumer spending patterns due to economic downturns or recessions can significantly affect Chipotle’s performance. For instance, during the 2008 financial crisis, Chipotle experienced a decline in sales as consumers tightened their budgets.

Investor Sentiment and Market Expectations

Investor sentiment and market expectations are crucial drivers of Chipotle’s stock price. Positive sentiment, driven by factors such as strong earnings reports, new menu launches, or successful marketing campaigns, can lead to an increase in demand for the stock, pushing the price higher. Conversely, negative sentiment, fueled by concerns about slowing sales growth, rising costs, or negative media coverage, can lead to a decline in demand and a drop in the stock price.

Analysts’ ratings and price targets also play a role in shaping investor sentiment. When analysts issue positive ratings and high price targets, it can encourage investors to buy the stock, driving up the price. Conversely, negative ratings and low price targets can discourage investors, leading to a decrease in demand and a potential drop in the stock price.

Company-Specific Events

Specific events or announcements related to Chipotle can have a significant impact on the stock price. These include:

New Menu Launches

Successful new menu launches can attract new customers and boost sales, leading to a positive impact on Chipotle’s stock price. For example, the introduction of the Carne Asada option in 2014 was met with strong consumer demand, contributing to a rise in Chipotle’s stock price. Conversely, poorly received menu items or changes can negatively affect sales and investor sentiment, leading to a decline in the stock price.

Store Openings

Expansion plans and new store openings are closely watched by investors as they indicate the company’s growth prospects. Successful store openings can lead to increased revenue and profitability, driving up the stock price. However, if new store openings fail to meet expectations or result in lower-than-expected sales, it can negatively impact investor sentiment and the stock price.

Changes in Management

Changes in management can also affect investor sentiment and the stock price. If a new CEO or other key executives bring fresh ideas and strategies that are well-received by investors, it can lead to a rise in the stock price. Conversely, changes in management that are perceived as negative or risky can lead to a decline in the stock price.

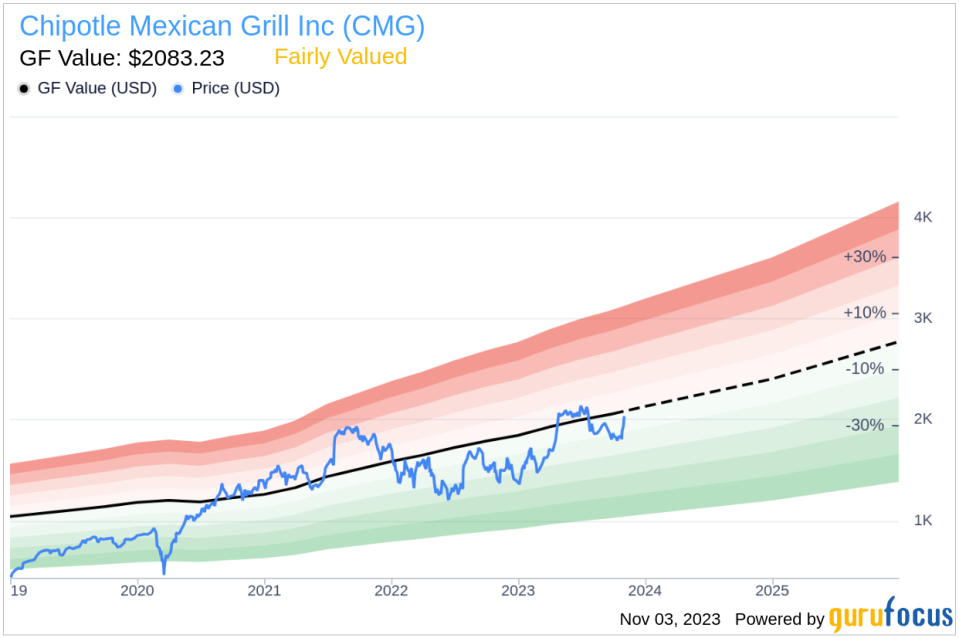

Chipotle stock has seen significant fluctuations in recent years, mirroring the broader market trends. However, its growth potential remains tied to its strong brand and commitment to fresh ingredients. Brian Nichols , a renowned digital marketing expert, emphasizes the importance of a clear brand identity in today’s competitive landscape, a lesson Chipotle has undoubtedly learned.

This focus on brand differentiation, coupled with its operational efficiency, could drive future success for Chipotle and its investors.

Chipotle stock has seen its fair share of ups and downs, reflecting the company’s commitment to fresh ingredients and its efforts to navigate challenges like food safety concerns. The leadership of ceo of chipotle plays a crucial role in shaping the company’s future, and their decisions have a direct impact on investor confidence and the overall trajectory of Chipotle stock.